Pinpoint helped reduce Loss Ratio by 3 points to optimize profitable growth

Client: National Home Insurance Carrier

Line of Business: Home Insurance

Number of Policies: ~300,000

Average Individual Premium: $2,900

A national home insurance carrier partnered with Pinpoint to receive Loss Predictions at the top of the funnel (before the customer journey begins). Their current models are only available after the application is fully developed and all reports are ordered (e.g. Property Loss Reports, Inspections, Replacement Cost Reports, Credit, Prefill). In contrast, Pinpoint predictions are available before the application is developed, as soon as a customer name and address is known.

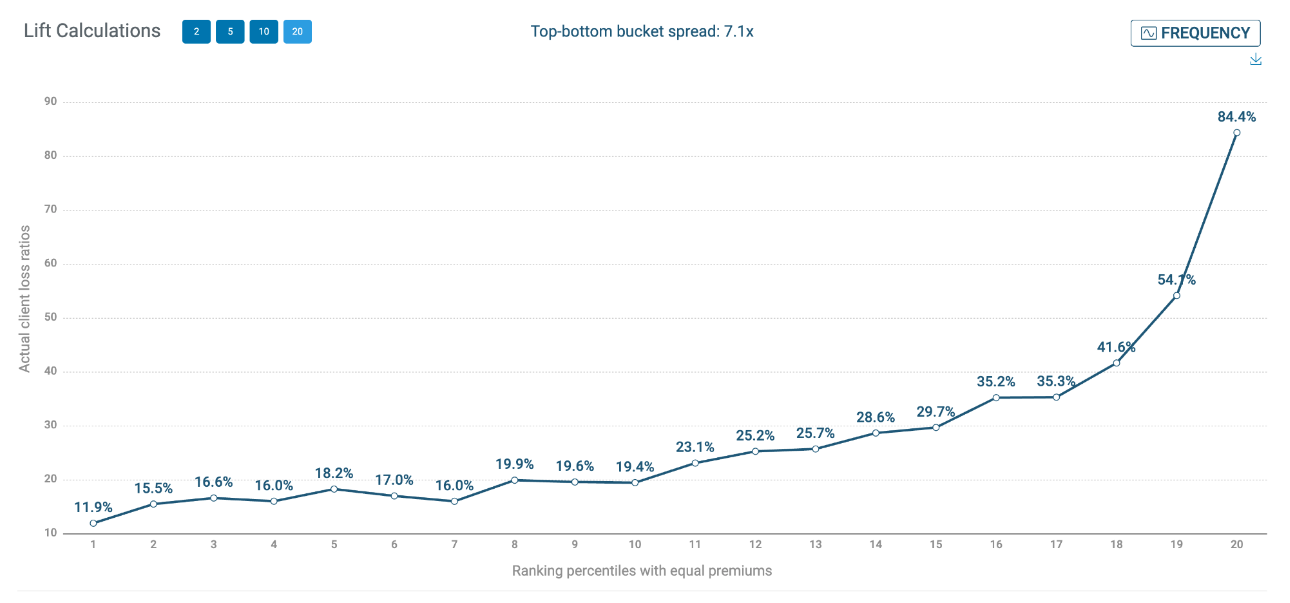

Loss Prediction Claims Frequency Results

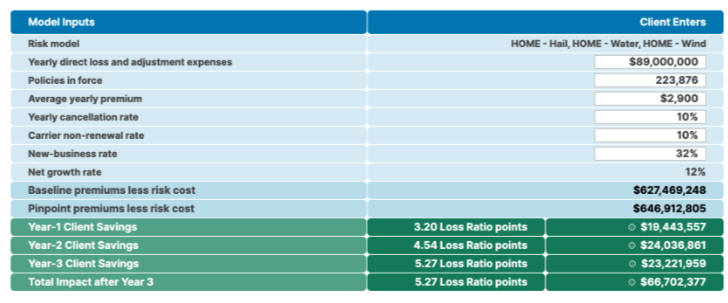

ROI Calculator Results

The carrier’s one-year loss ratio impact using Pinpoint’s prediction estimated a 3.20 point loss ratio improvement.

The three-year impact estimates how the shape of the risk profile of their book of business will change over time, with a projected profit improvement of $67 million.

Our ROI calculator incorporates the predictive model’s lift by decile to project how new insights can prioritize actions to align with the insurer’s goals of profitable growth.

Why Work with Pinpoint?

Pinpoint’s Lift Charts allow insurers to identify individuals with an exceptionally high loss ratio for whom they do not have an adequate rate. This early prediction, available as soon as they have someone’s name and address, helps the insurer flag an alternate application journey for that potential insured. Pinpoint’s Loss Predictions can help unlock a new source of intelligence for home insurers to fast-track their profitable growth.