Pinpoint helped reduce Loss Ratio by 3 points with Claims Severity Predictions

Client: National Auto Carrier

Line of Business: Auto Insurance

Number of Policies: 714,577

Average Premium: $2,495

Challenge for Auto Insurer: A national auto insurance carrier looked to augment their modeling and solve the problem of balancing business against increasing claim payouts, increasing costs of labor and parts, and the inflation of goods through behavioral predictions. They were able to unlock loss ratio savings by partnering with Pinpoint and using Claims Severity Predictions for the challenge. These challenges are common pressures for insurers who are re-evaluating risk stratification so they can continue to better serve customers and improve profitability.

Results

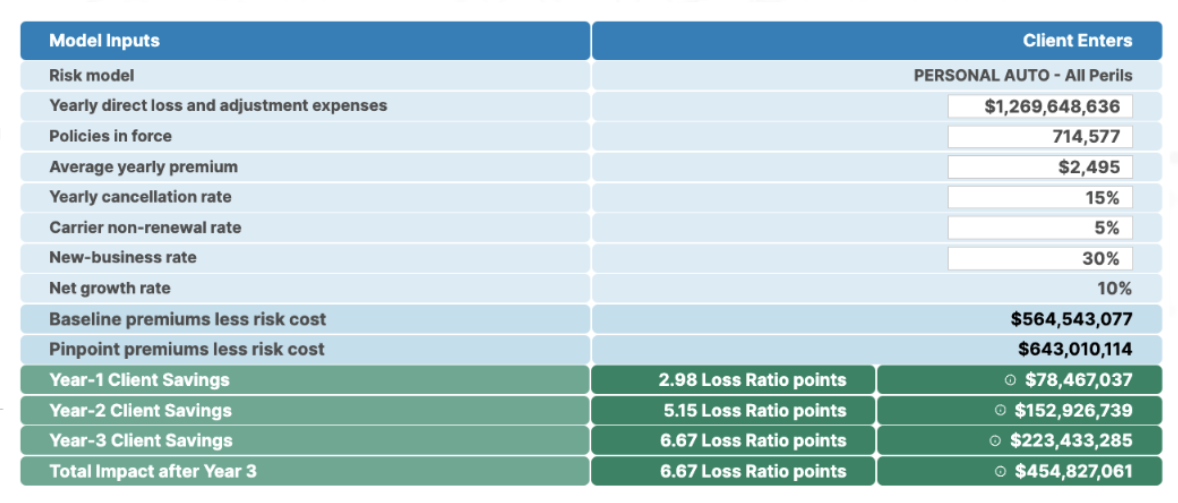

ROI Calculator Results

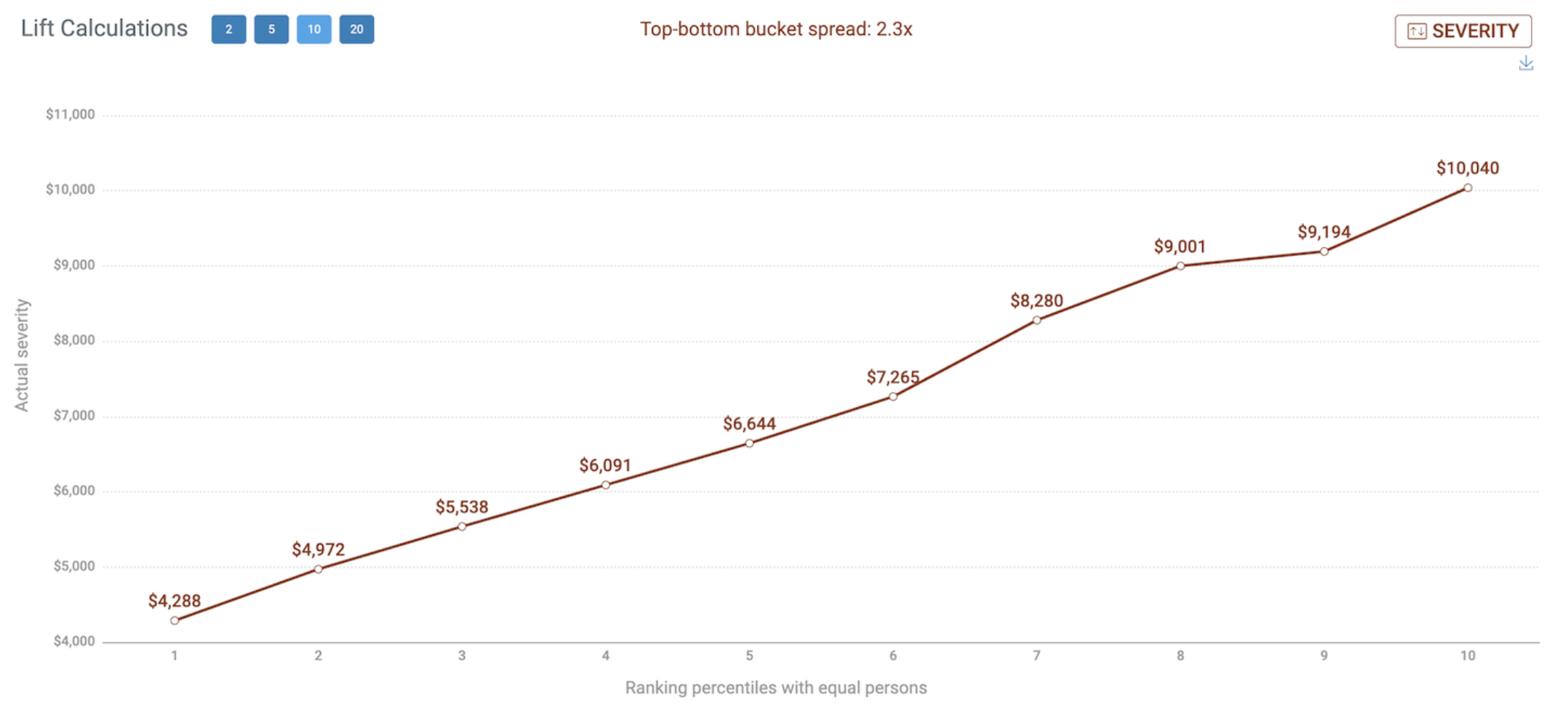

The carrier’s year-one loss ratio impact using Pinpoint’s prediction estimated a 2.98 points loss ratio improvement with a total loss ratio improvement of 6.67 points after the third year.

The client saw a 1st-year ROI of over $78M and a total 3-year ROI of over $223M for their carrier’s auto-book of business using Pinpoint Loss Predictions.

Our ROI calculator incorporates the predictive model’s lift by decile to project how new insights can prioritize actions to align with the carrier’s goals of profitable growth.

Why Work with Pinpoint?

Pinpoint’s lift chart allows the carrier to identify drivers with an exceptionally high loss ratio for whom they do not have an adequate rate. This early prediction, available as soon as they have someone’s name and address, helps the carrier flag an alternate application journey for that potential insured. Pinpoint’s Loss Predictions can help unlock a new source of intelligence for auto carriers to fast-track their profitable growth.