“Non-weather water claims cost insurers $8.2 billion annually in personal lines alone, or 20% of all property insurance losses in the U.S. The average non-weather water claims cost $6,695 in personal lines but can vary from $1,560 to more than $75,000 depending on the expensiveness – and expansiveness – of the damage.”

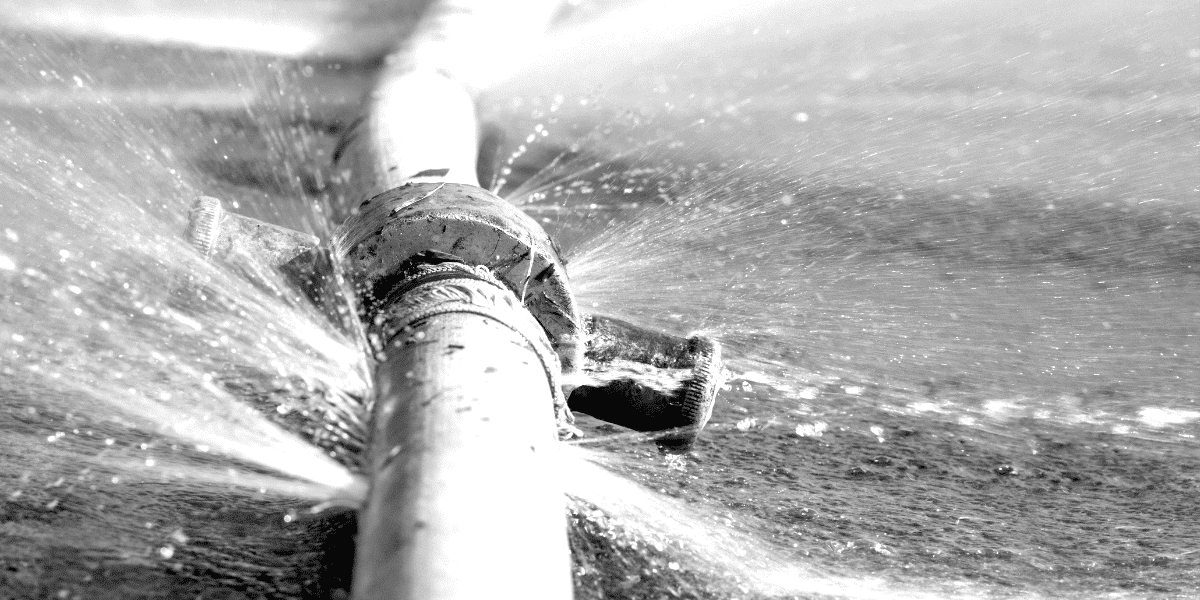

Non-weather water loss poses a growing challenge for residential sectors due to its increasing frequency and severity. It is the second most common cause of homeowners’ insurance losses, yet it often remains overlooked and misunderstood. This peril is costing insurers upwards of $8B annually, with loss costs increasing.

“Non-weather water loss cost increased 8% and frequency increased 2% from 2020 to 2021 while severity increased by 6% in 2021.2” Lexis Nexis Home Insurance Trends Report 2022

With such high costs associated with non-weather water losses carriers stand to gain a substantial advantage by proactively identifying those customers that are likely to have higher than average non-weather water losses. By taking a more comprehensive and targeted approach, carriers can minimize their non-weather water claims, consequently improving their loss ratios and long-term profitability.

Improving Loss Ratios with Pinpoint’s Automated Risk-Selection Platform

Pinpoint Predictive provides carriers with actionable risk stratification that quantifies the expected loss associated with non-weather water perils at an individual prospect or customer level. By delivering this powerful risk insight at the top of the funnel and other key points of the customer journey, carriers can implement a unique strategy for each customer based on their risk level predicted by Pinpoint.

Going beyond traditional risk assessment methods, Pinpoint brings the power of trillions of individual behavioral predictors and advanced AI to provide carriers with a solution that addresses the rising costs of non-weather water and their impact on portfolio performance.

Pinpoint leverages trillions of behavioral predictors associated with over 250 million US adults, bridging the gap between insurance analytics and best-in-class behavioral predictions from other industries. Unique features of Pinpoint predictions are as follows:

- Trillions of behavioral predictors (no credit, no zip) that do not include biometrics, social media, language, or race, ethnicity, or their proxies

- Proprietary, first-party behavioral economics data, and statistical specialization in collecting and validating these.

- Deep learning algorithms

- Custom development of a best-in-class identity-resolution capability.

- Commitment to the highest ethical standards in the use of data and artificial intelligence

Pinpoint predictions are accessible via batch or API, and can be used either as standalone predictions or combined with existing models.

Implementing Pinpoint to Mitigate Non-Weather Water Losses

Pinpoint offers carriers several options to mitigate losses associated with non-weather water losses. During Pre-application, carriers can use Pinpoint to assess the non-weather water risk and determine the most appropriate customer journey for these individuals.

In addition, unlike weather-related losses, non-weather water losses are often preventable. Carriers can avoid or mitigate losses by powerful segmentation in the following ways:

- Targeted policyholder education

- Incentives for purchasing and/or adopting loss prevention devices (automated water shut-off valve, water sensors)

With access to individual-level intelligence regarding non-weather water risk at the top of the funnel and other points of the journey, carriers have the maximum flexibility in serving customers and managing portfolio profitability. Below are some examples of how Pinpoint’s tailored non-weather-water Loss Predictions can sustain and enhance portfolio profitability.

Figure 1: Implementation Options for Pinpoint Non-Weather Water Loss Predictions

| Non-Weather Water Loss Prediction | Potential Action | Impact |

| Highest Risk | Insurance companies can potentially avoid risks that are significantly above average for non-weather water risk. For these customers, carriers can ensure the appropriate underwriting resources are applied to this application. | Reduce Loss Ratio of Portfolio |

| Higher than Average Risk | Carriers can offer alternative products or higher deductibles and/or require risk mitigation (e.g., water sensors, water shut-off valves). If carriers work with multiple underwriting companies, they can leverage Pinpoint to effectively direct their submissions to the most suitable underwriter based on the associated risk profile. | Reduce Loss Ratio of Portfolio |

| Average or Lower than average Risk | Potentially increase the number of low-touch or no-touch applications to segment potential new business that should be considered for straight-through processing. | Reduce Underwriting Expense |

| All Customers | Determine the most appropriate customer journey for each new customer, including level of underwriting, seniority of the assigned underwriter, whether to request inspections, and whether to order any other downstream/or third-party data. | Reduce Underwriting Expense |

Pinpoint provides carriers with the flexibility to establish business rules that are most appropriate to each carrier’s risk appetite and portfolio goals. Figure 2 provides an example of Pinpoint’s predictions across ten groupings of equal premium for non-weather water loss.

Figure 2: Representative Lift Distribution for Homeowners Non-Weather Water Peril

Attaining this powerful measure of profitability with just a name and address – without any rating variables and before a prospect even completes an application – enables carriers to fast-track both profitability and rapid growth. Using Pinpoint Lift Charts, carriers can determine the “cut-off” points associated with business rules for the customer journey, as well as targeted interventions in the following ways:

- Customers in Groups 5-9 may be targeted for education about resources and mitigation approaches to non-weather water risk. Additionally, this group may be offered a discount for leak detection sensors or automatic shut-off valves. Whereas customers in Group 10 may be offered an alternative product or required to purchase a sensor.

- Carriers may decide to augment their customer acquisition strategy for the prospects in Groups 1-2 (lowest risk/highest profitability).

- Alternatively, carriers could implement an alternate business rule for the prospects in Groups 9-10 (highest risk/lowest profitability).

Additionally, carriers can leverage the Pinpoint ROI Calculator that uses their custom Loss Prediction or Risk Scores model to project the financial impact of using Pinpoint’s predictions over a 1 year and 3 year time horizon. This empowers carriers with a data-driven strategy to optimize profitable growth.

Figure 3 illustrates the financial impact of using Pinpoint pre-application and pre-renewal to shift the mix of risks for non-weather water risk. Conservatively this approach can produce savings of over $3.9 million in year 1 and over $11 million in a 3 year period.

Figure 3: ROI Calculator for Homeowners Non-Weather Water Peril

As the costs of rising non-weather water claims show no signs of slowing down, carriers are under pressure to implement alternative solutions that span beyond traditional risk assessment methods that utilize credit scores or zip codes. Pinpoint’s earliest loss predictions and risk scores, powered by behavioral predictors and deep learning, offer a unique solution to address the escalating costs on non-weather water claims.